Employees in the business – could they claim expenses against tax?

Employees have limited expenses which can be claimed and they need to be incurred “wholly and exclusively” in the performance of their duties. Expenses that serve a dual personal and business purpose are not claimable. An example is ordinary clothing worn at work. Clothing that is worn both in work and out of work obviously […]

Redundancies in the business

In these difficult trading times, there comes a time when some staff have to be let go but managingredundancies is not an easy process and is stressful for everyone involved. If your business is having to make some of its employees redundant, there are several legalities youneed to observe. The redundancy process should generally include: […]

Time is precious – make the most of it

Running a small business can be extremely hard for many business owners! There is so much to do – day to day administration, dealing with staffing and employees, marketing,chasing sales leads, looking after and servicing clients and customers, managing social media and webpages…the list goes on. What did you actually intend to do when you […]

A roof replacement company will have to pay £2.5m in VAT after the Court of Appeal ruled that insulated roof panels were not classed as insulation for a VAT-reduced rating

The Court of Appeal ruled that the appellant, Greenspace Ltd, which supplied conservatory roof insulation in the form of insulated roof panels, was not eligible for a VAT-reduced rating. It charged VAT at the reduced rate of 5% on the basis that the supply was one of insulation for roofs and therefore ‘energy-saving materials’ under […]

Would graphs and charts make your figures more understandable?

A characteristic of many people is that pictures convey messages in a more understandable manner than figures.Pages of reports full of tables etc can be very off-putting and it can be difficult to see the proverbial wood for the trees. In the same way as the car dashboard gives you at a glance all the […]

Automating processes in accounting

The more manual the process, the greater the likelihood is of error. Whether this is missing items out, transposing numbers, entering items incorrectly etc, mistakes can be costly.Accounting software takes away some of the potential issues. Just one simple example from the days of manual handwritten records; a not uncommon mistake was to transpose figures […]

Ways to improve cash flow

The old adage “Cash is King” has rarely been truer. No cash means you are unable to pay your employees, your suppliers and even yourself. If you have a significant amount tied up in debtors and/or work in progress, rather than in your bank account, there are steps you can take to improve this position.⦁ […]

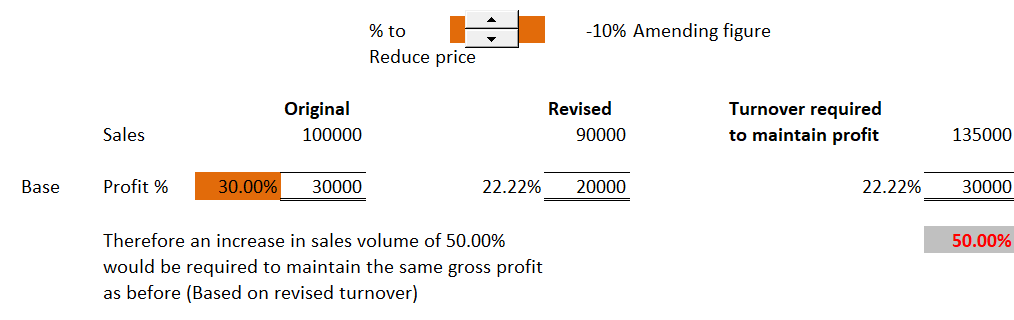

The effects of cutting prices – do you realise how much more you need to sell to achieve the same level of profit?

It is very easy to reduce prices, but in doing so, this will affect your gross profit margin. Yes, it might be that you actually increase unit sales, but will this increase your bottom-line profit, or will you make less money? How much harder might you have to work to sell more? See the image […]

Payroll – are the settings correct

There are many areas where payroll can “go wrong”, sometimes with costly consequences. In setting up payroll, there may be different pay elements that need to be created – common ones are basic pay, overtime pay, holiday pay, bonus etc. Sometimes reimbursed expenses or loan advances may be paid within the payroll too. There may […]

The Autumn Statement 2022

Now the dust is settling after the recent announcements, Government U-turns and further announcements, it is time to draw breath and focus on the changes (although we may see more in the March 2023 budget)! An attention-grabbing headline appearing around the place is that everyone will be paying more tax over the next few years. […]