Time is precious – make the most of it

Running a small business can be extremely hard for many business owners! There is so much to do – day to day administration, dealing with staffing and employees, marketing,chasing sales leads, looking after and servicing clients and customers, managing social media and webpages…the list goes on. What did you actually intend to do when you […]

The Local Startup Show – Back2back Roofers – TLSS001

This week we sit down with father and son Bob and Aaron, co-owners of Back2back roofers Ltd. We discuss the challenges of going from employed to self-employed to a business owner as well as what it’s like being in business with your dad/son! Bob and Aaron also gave some great advice that could be super […]

CBI calls for tax breaks to support business

Business confidence fell across the service sector for the three months to February, as cost pressures hit consumer spending, according to the CBI The fall was at a slower pace than in the previous quarter as profitability continued to drop and cost pressures remained elevated in both business and professional services – which include accountancy, […]

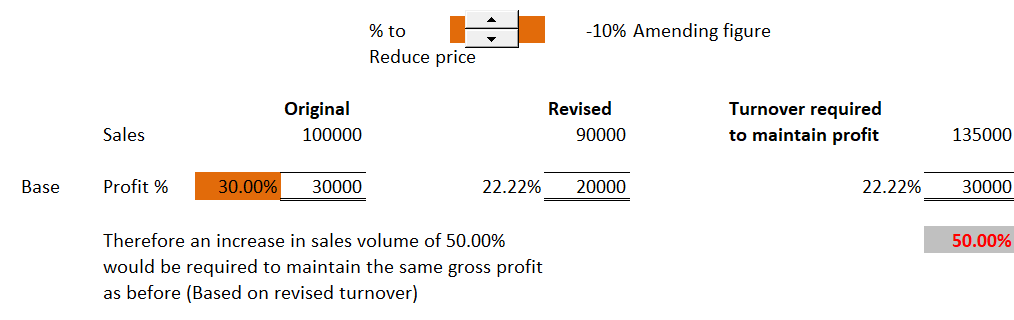

The effects of cutting prices – do you realise how much more you need to sell to achieve the same level of profit?

It is very easy to reduce prices, but in doing so, this will affect your gross profit margin. Yes, it might be that you actually increase unit sales, but will this increase your bottom-line profit, or will you make less money? How much harder might you have to work to sell more? See the image […]

Bookkeeping – keep your business and private spending separate!

Business expenses can be claimed against tax, but personal expenditure cannot. It is therefore necessary to distinguish between the two. Many businesses on starting up will continue to use a “personal” bank account for their business transactions. However, it will be far easier to administer if a business account is opened up at the outset. […]

Inheritance Tax – Have you given this any consideration recently?

Inheritance tax is a charge that can be applied on the estate (the property, money and possessions) left behind when someone dies. You shouldn’t need to worry about IHT if: If your estate is worth more than £325,000, anything above this threshold could be subject to IHT at a rate of 40%. There is also […]

Turmoil in the finance world!!

The recent announcements by then Chancellor Kwasi Kwarteng regarding tax and NI cuts, changes to proposed corporation tax rates etc were welcomed by some, but it threw the financial markets into meltdown. The announcement that the additional tax rate of 45% for those with income over £150,000 was to be cut to 40% was the […]

Interest on late payment of tax

HMRC interest rates are linked to the Bank of England base rate, and the increase in early August from 1.25% to 1.75% has triggered another increase in rates for late payments. This takes effect from 15 August 2022 for late quarterly instalment payments, and late payment interest for other late payments will increase from 23 […]

Employer PAYE — new recurring Direct Debit functionality

Currently employers can set up a Direct Debit to collect a single payment, but not a recurring Direct Debit. By mid-September HMRC should have in place the ability to set up a recurring Direct Debit for employers. This aligns to the ambitions of the HMRC Payments Strategy, to make available one consistent set of payment […]

VAT – 20%, 5%, 0%, Exempt, outside scope? Which rate should you charge?

HMRC has updated their guidance document – VAT rates on different goods and services.. The guide covers a range of business types such as health, education, welfare and charities, sport, food and drink, building and construction, land and property etc.. If you are unsure or would like confirmation that you are dealing with VAT items […]