Salary…. or not…. or dividend?

The tax system is complex – and it does not get any easier!! Changes to the tax system from April 2023 make tax planning increasingly more problematic. The corporation tax rate was 19% in 2022/23 – but from April 2023, it could be 19%, or 26.5% on some profits or 25%. Dividends taxable at 0% […]

The tax year end is also the payroll year end….

So, get it right

If you are an employer running payroll, you will need to report to HM Revenue and Customs (HMRC) on the previous tax year (which ends on 5 April 2023), give your employees a P60, and prepare for the new tax year, which starts on 6 April. Important dates around payroll year-end include: The late filing […]

Employees in the business – could they claim expenses against tax?

Employees have limited expenses which can be claimed and they need to be incurred “wholly and exclusively” in the performance of their duties. Expenses that serve a dual personal and business purpose are not claimable. An example is ordinary clothing worn at work. Clothing that is worn both in work and out of work obviously […]

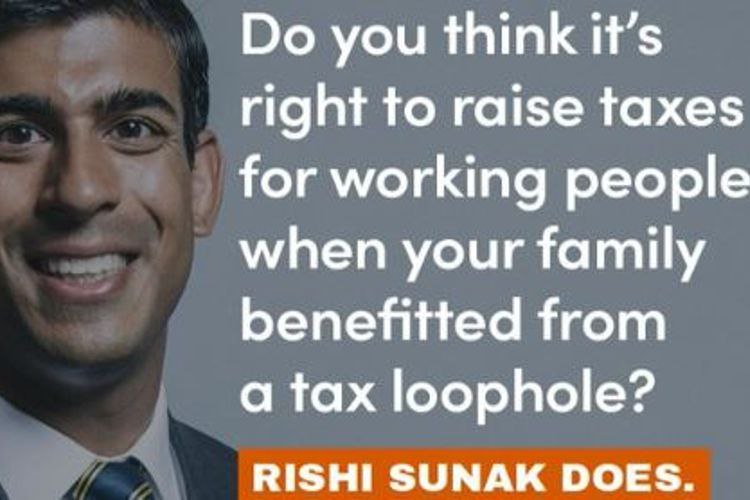

Labour criticises Rishi Sunak’s tax affairs

The Labour Party has taken aim at Rishi Sunak and his tax affairs with an advert targeting his wife’s previous non-dom tax status In a string of political adverts on Twitter, the Labour Party has criticised the prime minister for benefiting from a non-dom tax loophole as households continue to struggle with the rising cost […]

HMRC frees up Agent Dedicated Line for SA penalty enquiries

HMRC is making a temporary change to the Agent Dedicated Line for accountants and tax agents to help reserve capacity on the line specifically for one-to-one support at the start of the tax year For six weeks between 17 April and 2 June, the Agent Dedicated Line (ADL) will only deal with calls relating to […]

Tax changes from 1 April 2023

The rate of corporation tax has increased by a third from 19% to 25% for the largest businesses from 1 April and full expensing is available for three years Businesses with profits below £50,000 will not be affected as the government has introduced a small profits rate for those companies. A tapered rate will also […]

Last minute year end tax planning tips

With days to go before the tax year ends on 5 April, Blick Rothenberg issues a list of tax planning actions taxpayers may wish to consider before the deadline Paul Haywood-Schiefer, a senior manager at Blick Rothenberg, gives his view on what can be done. Use your allowances Remember you have a range of tax-free […]

TV presenter Eamonn Holmes loses IR35 tax case

In the latest IR35 case, presenter Eamonn Holmes has lost an appeal at the Upper Tribunal against HMRC leaving him liable to pay an unspecified amount in tax The case, first heard at the First Tier Tribunal in February 2020, considered whether Holmes was directly employed by ITV between 2011-12 and 2014-15 as a presenter […]

HMRC fines tax evaders £34.4m in penalties

An employment agency, hologram manufacturer and road haulier have been fined over £20m for tax evasion, in a record quarter where £34.4m in penalties have been issued The latest HMRC deliberate tax defaulters list showed that nearly 200 companies and individual taxpayers have been identified for evading taxes totalling £44,617,823.45. This figure was up substantially […]

Redundancies in the business

In these difficult trading times, there comes a time when some staff have to be let go but managingredundancies is not an easy process and is stressful for everyone involved. If your business is having to make some of its employees redundant, there are several legalities youneed to observe. The redundancy process should generally include: […]