Especially for those that use Xero or QuickBooks!

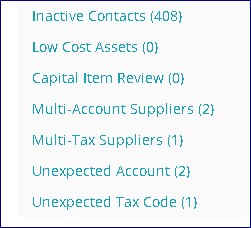

If you use Xero or QuickBooks for accounting purposes, there are various tools available that can link to the accounting records, interrogate them, and produce reports of potential anomalies. This might be postings with unexpected tax codes, or unexpected nominal accounts being used, possible capital expenditure analysed to expense accounts, duplicate invoices, etc.

This is extremely useful especially where it comes to VAT claims on expenses. It is all too easy to claim VAT where it should not be claimed and vice versa, to not claim VAT where it should be.

Whilst not totally “fool proof”, it can be a very useful tool to keep an eye on accounting records without having to review every single transaction in detail.

Contact us if you would like to discover more about our automated accounts review.